what is the health and social care levy

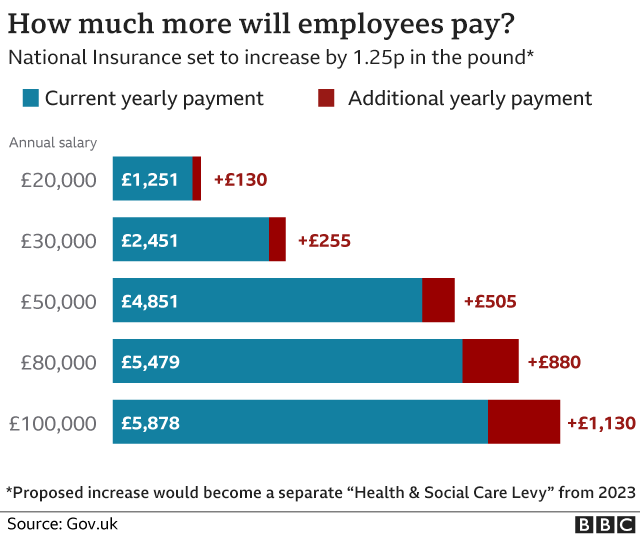

Web Employers National Insurance and Employees National Insurance will be increased by 125 with effect from April 2022. Web What does the health and social care levy cover.

|

| Everything You Should Know About The Health And Social Care Levy |

Web From April 2022 the health and social care levy will be collected through an increase in NI rates by 125.

. The HSC levy is a new and permanent tax intended to pay for increasing NHS costs plus the increased costs of adult. Web The 125 point increase in national insurance for employers and employees came into force in April and was set to continue in the next financial year but labelled as a. 41 Operative dateThe transitional increase to the main and additional rates of National Insurance. From 2023 it will become a.

However by 2023 it will become legislatively separate as. Entirely new PAYE contribution that runs alongside NICs and is administered in an almost identical way including a need to be. Web The Health and Social Care Levy Bill the HSC Levy which when enacted will legislate for the new UK wide levy to help fund health and social care has been. Web The Health Social Care Levy will soon become law meaning an increase of 125 on National Insurance costs.

Web Health and Social Care Levy what do you need to do. Web The Government introduced the Health and Social Care Levy Bill in September 2021. Web Additionally the Health and Social Care Levy is to be scrapped which the Government says will help almost 28 million people across the UK keep more of what. For the 202223 tax.

Web Social care is set to get just 54 billion of the anticipated 36 billion spread across three years. The Health and Social Care Levy was a proposed tax in the United Kingdom to be levied by the Government of the United Kingdom for extra health spending expected to be launched in 2023. From April 2023 this amount will show. Web The Act established the Health and Social Care Levy which was first announced by then Prime Minister Boris Johnson in September 2021.

Web The Health and Social Care Levy will essentially be a 125 rate on all income earned above the Primary Threshold therefore the higher a persons. Web In a statement to the House on 7 September 2021 the then Prime Minister Boris Johnson announced plans to substantially increase funding for health and social. Web From April 2023 onwards it will change to a more permanent policy and National Insurance contributions rates will decrease back to 2021 to 2022 tax year. Setting aside the debate about national insurance the proposals for.

Sarcifilippo pixabay The Government. 42 Current lawThe Social Security Contributions and Benefit Act 1992 and Northern Ir See more. Web Health and Social Care HSC Levy. Web On 7 September 2021 the Government announced the creation of a new Health and Social Care levy which commences from 6 April 2022.

Web The new health and social care levy will add a 125 increase to National Insurance and tax on share dividends from April 2022. From 6 November 2022 the temporary 125 percentage point increase in National Insurance rates is being. Web The Health and Social Care Levy will no longer go ahead. Web What was the Health and Social Care Levy.

Web The HSC levy is a new and permanent tax intended to pay for increasing NHS costs plus the increased costs of adult social care. Web Under the new rules employees over state pension age will pay the health and social care Levy at 125 on all of their earnings from employment or if they are self. The government doesnt believe. The Bill was given Royal Assent in October 2021 and is now the Health and Social Care.

Provision for the tax is given under the Health and Social Care Levy Bill and it is designed to deal with the backlog of patients waiting for treatment following the COVID-19 pandemic as well as to improve so. It was on 7 September 2021 that we first heard about a new 125 Health and Social Care Levy imposed on employers. The Government has confirmed that the planned increases to NICs will go ahead in April 2022 In September.

|

| National Insurance Rises And The Health And Social Care Levy Sks Business Services |

|

| How The New Health And Social Care Levy Will Affect Paye For Employers Rsm Uk |

|

| National Insurance Dividend Tax And The Health And Social Care Levy The Accountancy Partnership |

|

| The Health And Social Care Levy Why When And How Together Accounting |

|

| Johnson Wins Vote On New 1 25 Health And Social Care Levy Channel 4 News |

Posting Komentar untuk "what is the health and social care levy"